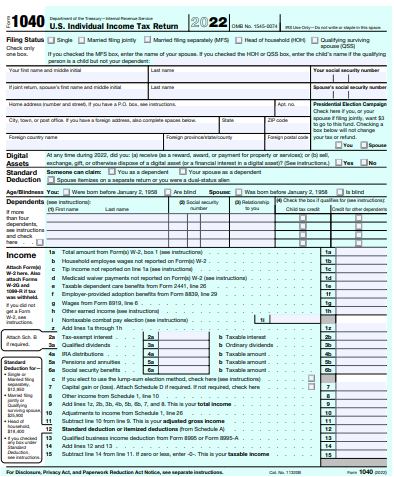

2024 Schedule 1040 Tax Form – The Schedule 3 tax form is part of the 1040 tax return. Taxpayers who are eligible to claim nonrefundable credits must complete Schedule 3 and attach it to their 1040 return. Nonrefundable credits . Tax season — with its homeowner tax benefits — is one of the few times you may actually get some money out of your house instead of pouring money into it. Owning a house in the .

2024 Schedule 1040 Tax Form

Source : www.incometaxgujarat.orgAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

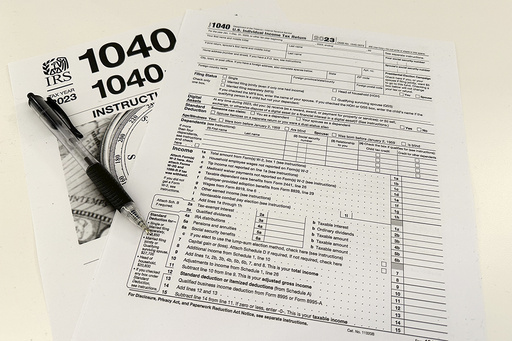

Source : www.investopedia.comArizona, federal tax season begins with changes, tips for filers

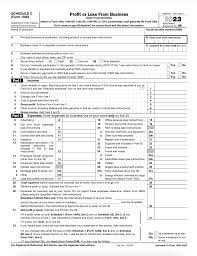

Source : yourvalley.netHarbor Financial Announces IRS Tax Form 1040 Schedule C

Source : www.kxan.comForm 1040: U.S. Individual Tax Return Definition, Types, and Use

IRS 1040 Schedule 1 2022 2024 Fill and Sign Printable Template

Source : www.uslegalforms.com1040SCHED1 Form 1040 Schedule 1 Additional Income and

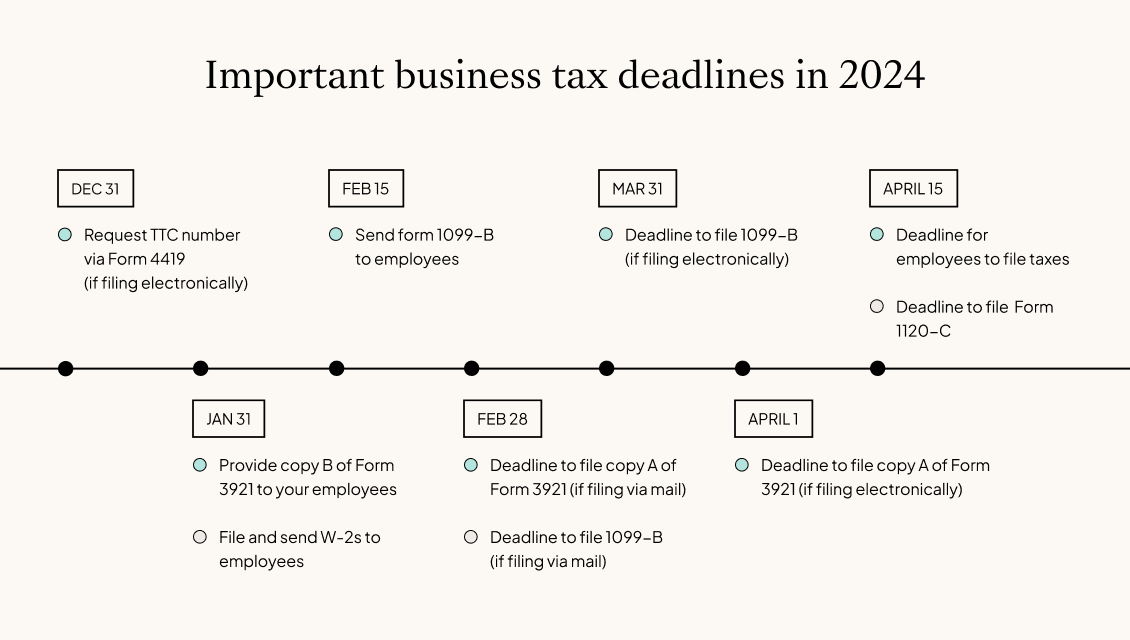

Source : www.nelcosolutions.comBusiness tax deadlines 2024: Corporations and LLCs | Carta

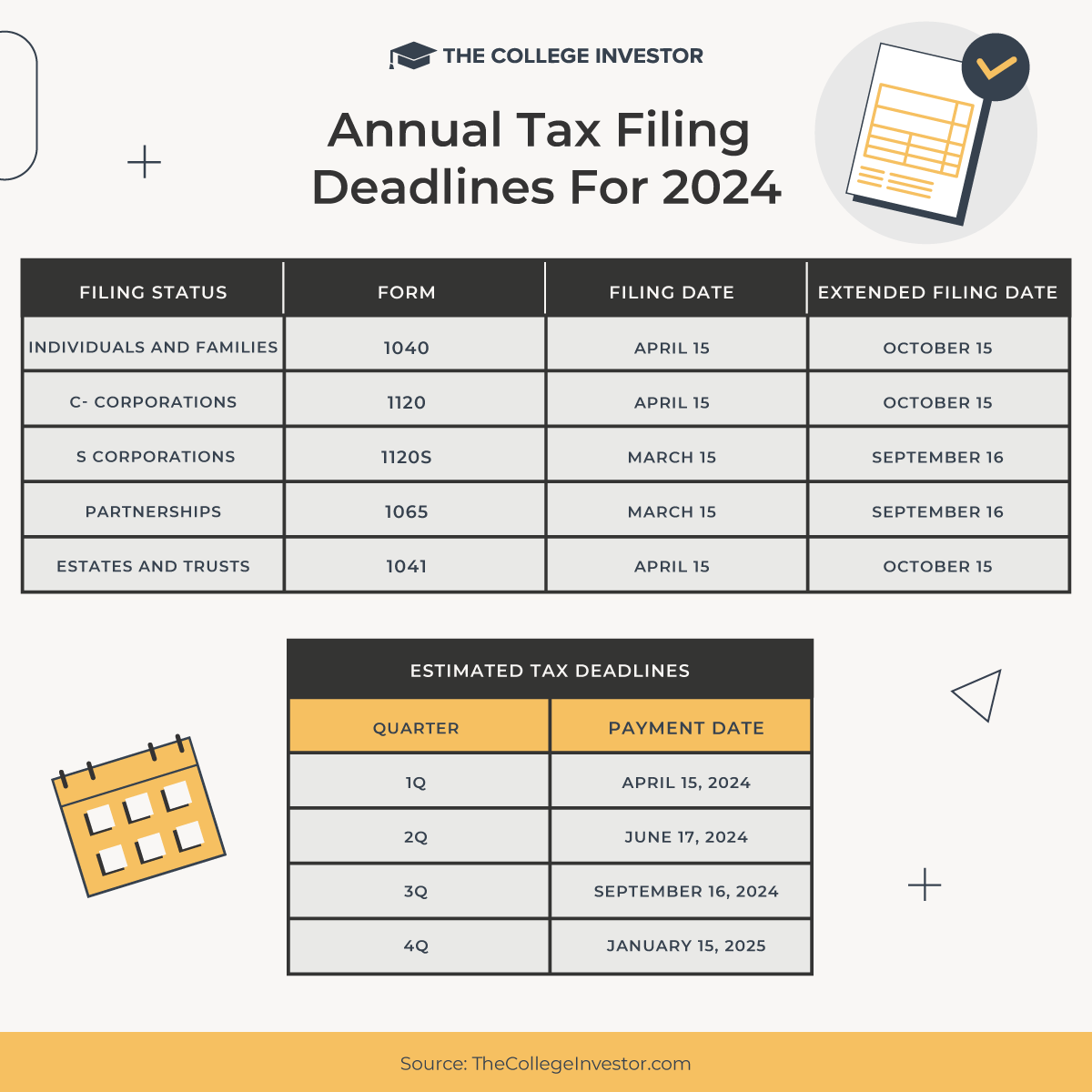

Source : carta.comTax Due Dates For 2024 (Including Estimated Taxes)

Source : thecollegeinvestor.comIRS to Launch Free E Filing Program in 2024. Here’s What to Know

Source : www.nbcboston.com2024 Schedule 1040 Tax Form Form 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions : This guide provides information on the different payroll tax forms and deadlines specific to household employers, helping you navigate the process with ease. . to submit alongside your Form 1040. Schedule A, for example, is a tax form familiar to those who itemize deductions on their tax return instead of taking the standard deduction. With this user .

]]>

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

:max_bytes(150000):strip_icc()/Screenshot2023-12-15at12.57.18PM-4df7a66986cf4a1ab5cc962b78b698fd.png)